Effect of China’s recent shutdowns on its GDP, global trade and real estate

The successful strategy for containing the coronavirus that China used in earlier stages of the pandemic is not working as well with the highly contagious omicron strains, and the entire country and world economy are feeling the effects.

According to the European Chamber of Business in China, freight volumes in Shanghai were down about 80% year on year in April 2022, causing supply chain issues in Europe and America where in some places manufacturing, port processing and inland transportation have for the past six weeks been running at a fraction of their usual rate.

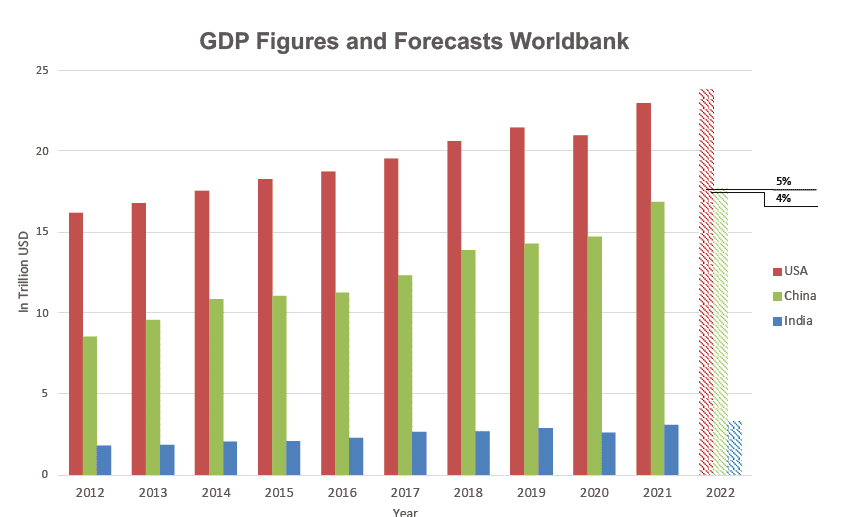

The International Monetary Fund (IMF) has lowered its 2022 China GDP forecasts from 5.8% to around 4.4%, and other economic advisories are predicting similar figures.

The larger perspective

The drastic measures taken in Shanghai to stop the spread of omicron, which is known to have lower mortality rates, seems to have taken many business leaders in China by surprise, while the rest of the world is likewise surprised to see China’s economy drastically slowed once again by a coronavirus. In the heat of the moment, one now sees headlines predicting economic damage to China so severe as to be irreversible.

But the sudden economic setback may well be followed by a recovery that is also faster than expected. Even if the gloomiest predictions (Nomura capital: 3.9% GDP) should come true, then China’s GDP for 2022 will still grow by USD 700 billion — an amount equal to the GDP of Switzerland.

And China may end up with a better 2022 performance than that. A gradual, phased ending of the Shanghai lockdown has begun, and the government has indicated that it may be taking a more flexible approach in fighting the spread of the virus. So far, outbreaks in other parts of the country since April have been largely brought under control.

Many businesses currently have full order books and are ready to satisfy pent-up demand the moment workers are able to return to their offices and factories.

And if needed, China still has available unused stimulus funds for countering the effects of the pandemic.

Property rental rates

Compared to the situation in early 2020, commercial and industrial landlords in mainland China are at this point bullish and hence not offering the amount of flexibility, discounts and relief to their tenants that they did two years ago. Landlords that are state-owned-enterprises, however, are being asked to provide some rent-free time to their SME tenants.

Recovery

Losing almost the entire month of April in economic activity will certainly affect year-end results for many China businesses and for the economy as a whole. But given China’s strong economic situation prior to the recent lockdowns and the ongoing strong demand for goods and services, things may well look better at the end of 2022 than many currently expect.

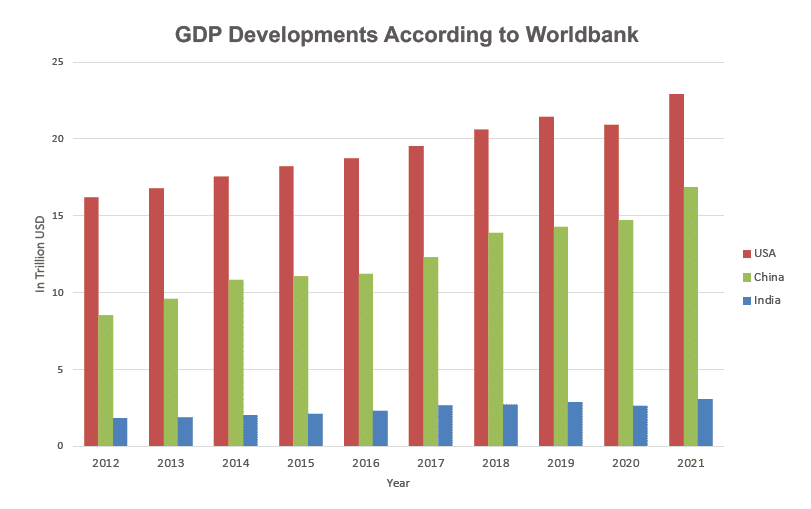

Growth of 4.8% for 2022 seems quite possible at this point in our opinion, which would mean an addition of USD 830 billion to China’s economy, the equivalent to the GDP of countries such as Sweden or The Netherlands. That amount would raise China’s overall GDP for the year to USD $18.5 trillion, which is 80% of nominal US GDP for 2021.