U.S. Office Market

The past year or so has seen more and more transactions in the United States where office buildings are being sold for less than half of what they were bought for. A typical example was the sale of a 10-story building in Manhattan by an affiliate of Related Companies. The company had acquired the property in 2018 for USD 153 million, and this year sold it for less than USD 50 million, a price drop of about 65%.

Several culminating factors have created a perfect storm for owners of US office buildings and the banks who finance them:

• High vacancy rates as a result of increased work-from-home, leading to lower rental incomes for office building owners

• Further reductions in office landlord rental incomes from the concessions they are forced to give in order to retain and attract tenants

• End of a low-interest-rate environment, leading to higher yield expectations among buyers

The combination of these factors has created a situation where office buildings in many US cities have lost about 60 to 70% of their values. In Europe the situation tends to be a bit less dramatic, but the overall pattern is similar.

China Office Market

In China and other major Asian markets, where work-from-home is not as much of a thing, the drop in office occupancy and rental rates has been far less dramatic but yield expectations in some areas have changed significantly. And since these factors are multiplied together in valuation calculations, the overall effect can be large. Take an office tower in Shanghai’s Huangpu District as an example: With a rental income of about CNY 8 / m2 / day, an occupancy of 90% and yields of about 4.5%, the building was valued at around USD 800 million in 2018. With just slightly lower rental rates of about CNY 7 / m2 / day, slightly lower occupancy of about 80% and expected yield of about 5.5%, the building is now, in 2024, valued at only USD 500 million. So while rental rates fell merely 10%, the property is now deemed 40% less than what it was worth six years ago.

Industrial Properties

China’s industrial properties, including manufacturing spaces and warehouses, have also dropped in value, albeit at smaller magnitude. Occupancy rates are still high and rental rates are stable or even increasing, but in this sector as well yield expectations have risen, with investors targeting returns of about 8% compared to 6% two or three years ago. Taking all factors into account, industrial property values have dropped about 20% from their recent highs.

Residential Real Estate

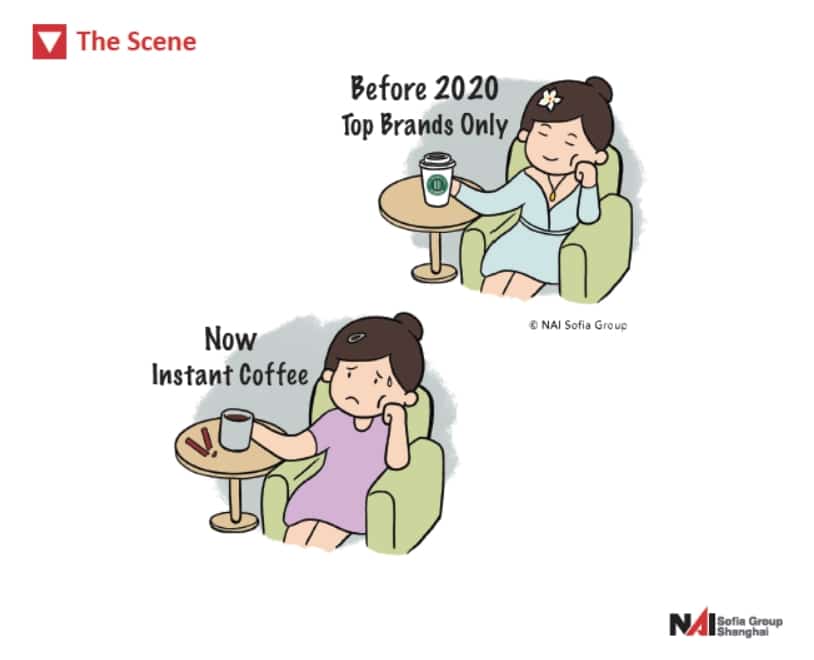

For apartments the situation is, funny enough, somewhat similar to the situation of factories: stable rental rates but about 20 or even 25% lower sale prices. This may have less to do with changing interest rates, however, and more to do with overall consumer confidence and changing attitudes, including trust in continued capital appreciation.

Retail Facilities

Valuations of retail properties such as shopping malls had already endured a much earlier wave of decline which became especially noticeable starting about eight years ago as booming e-commerce killed off most classical retail activities in shopping malls. This drove rents lower and return expectations higher. Since then, most retail developments have successfully refocused their tenant mix towards food and beverage, entertainment, education, medical and wellness companies, and at this point they have proven to be an astonishingly resilient asset class, with both rental rates and sale prices largely stable.

Hotel Buildings

The situation for hotel buildings is a mixed bag. Occupancy rates and room prices, which largely determine valuations, depend heavily on location. We do see some hotels — which in China more often than not are held by developers — with low occupancy rates struggling to survive. Because it has become more difficult for non-SOE developers to access bank loans and financing in general, projects can now quickly run into solvency issues. In the old days such assets may just have just been kept on the balance sheet, potentially even with values increasing on positive economic trends.