The trillion-dollar question at this point in time is whether China’s residential property market has reached bottom or not.

The million-dollar questions include: How is current market demand for office and industrial properties? What overall developments and prices can be expected in China over the coming six months?

Has residential hit bottom?

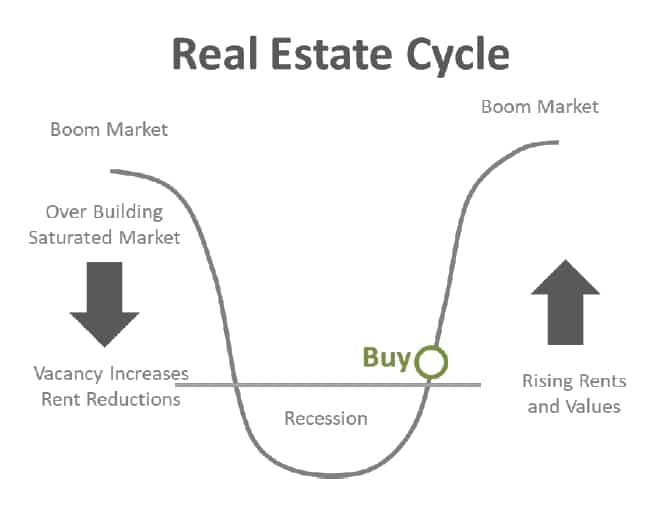

Property market downturns that took place over the past 100 years across the globe typically lasted for about 3 to 8 years, according to research by Deutsche Bank. Below is a diagram depicting the phases of a typical market cycle which is based on a concept first published by Mueller in an article in Real Estate Finance in 1995:

Assuming the current downturn is towards the short end of the range quoted above, then the Chinese residential property market may have already hit its low point – but is that assumption correct? Below we summarize the facts supporting and undermining it.

Facts supporting idea of an imminent residential market turnaround

- Government has initiated significant economic stimulus programs

- Central and regional governments have launched initiatives specifically to support the real estate sector

- Some locations and certain submarkets, for example sale of tenanted apartments, have already shown upward trends

- Ongoing urbanization and replacement of buildings from the 1950s and 1960s create demand for new apartments

Facts suggesting residential downturn to continue at least another year

- Oversupply will need a long time to get absorbed as there is a great amount of it and the population is shrinking

- Economy no longer in boom-mode, even though GDP growth is higher than in most other countries

- Investor confidence is lower than in the past

- An unusually long growth period – China’s property prices ascended for more than two decades – may suggest a prolonged cooling down period

Before we forecast how these forces will balance out and suggest the most likely timing of the residential turnaround, let’s first turn to the commercial and industrial property sector outlooks, as these have bearing here as well.

Retail: pleasant surprise

Apart from residential, the various segments of market China’s property market are looking more positive for investors, in some cases surprisingly so.

Even though China is one of the leading countries when it comes to e-commerce and relatively little shopping is still done in shopping malls, retail properties as an asset class are bucking expectations and performing well. At least in more densely populated areas, shopping malls tend to be well occupied with a lot of food and beverage, education, entertainment, showroom space, and the possibility to look at physical products even though purchases may take place online. We expect retail rents to remain stable at their current level and occupancies of retail properties to be solid as they serve as major gathering points and centers of leisure activities for large parts of urban society.

Offices: better than expected

The amount of office space taken up in major cities such as Shanghai is – to the surprise of many – still growing. Meanwhile, the amount of newly added office space has outpaced absorption.

From a landlord perspective, Shanghai’s office vacancy rate of around 20% compares favorably to the current situation in many big cities across the globe, and reflects the fact that work-from-home is not as much of a thing in Asia as it is in many Western countries. However, purchase prices for offices have dropped about 50% as buyers demand much higher yields than in earlier years. Buyers now expect the price of a building to be no more than the sum of about 13 years of rental income, compared to the 20 or so years that was commonplace before the downturn. In this context land-use-rights play an important role in determining price, as the usual office buildings leasehold is only 40 years.

We expect that office buildings will remain a ‘high risk, high return’ asset class for investors, and that companies renting office space will continue to enjoy attractively low rental rates and tenant-friendly lease terms.

Industrial: consistent performer

Without question China’s best performing asset class, industrial real estate includes factories, warehouses and laboratories. Occupancy levels for these properties are solid and return rates higher than for other property types.

In terms of manufacturing, China seems to have a clear edge over most other countries, and the strong demand in its industrial property market reflects this. We expect that factories, warehouses and other industrial buildings will remain in high demand in China. Given its advantages in raw materials, educated workforce size and other aspects of supply chain, the initiatives of other countries to move manufacturing out of China will in our view have limited effect on industrial property demand in the country, affecting only a minor percentage of its production capacity.

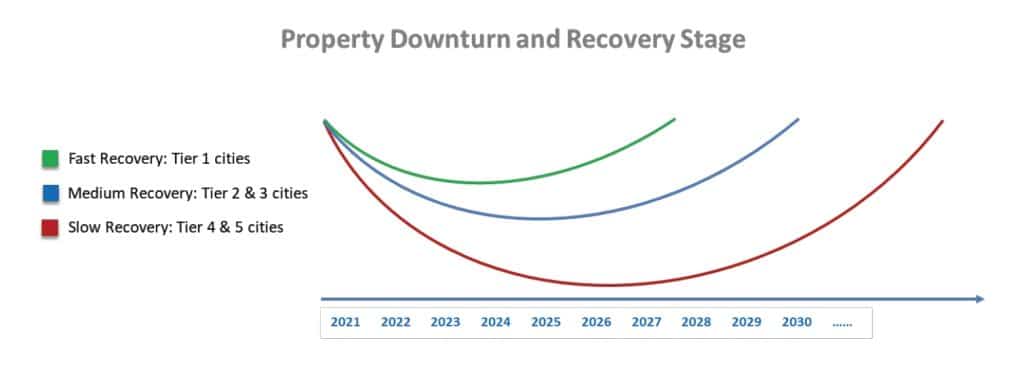

Timing of residential upturn likely will depend on location

Whether China’s residential property market is in the early, middle or late stages of the crisis may depend on which cities one is looking at. In top-tier cities on the East Coast such as Shenzhen, Shanghai and Beijing there is continued strong demand for apartments. Occupancies are high and many aspire to property ownership, at least for their primary residence. Employment rates and salary levels are high as well. It is likely that we see at least a number of apartment transaction prices go up again in 2025, and with a slight delay the average per square meter prices will likely trend upward again as well.

A similar process can be expected for tier-2 cities of prosperous provinces – Suzhou in the Jiangsu Province, Hangzhou in Zhejiang Province for example – but it will likely lag the big cities by a year or so. The amount of apartments changing ownership is very likely to go up again soon. And while prices may not necessarily trend upward immediately, they will most likely not fall further.

In more remote tier-3 and tier-4 cities it ultimately depends on the balance of supply and demand. For areas where the amount of available units is somewhat aligned with the mid-term market need, prices will stabilize as they will in larger cities. However, in cities which do not benefit from increased urbanization, have stagnant or declining population growth, or significant supply excess, it may take several more years until inflation and other factors eventually make prices appear low and start to trend up again.

According to official figures, overall apartment purchase prices are down by only about 10% over the past two years, but when taking various costly incentives into account – free parking, etc. – then a 20% decline would seem a more accurate estimate. Noting that in some prosperous areas prices have hardly gone down at all, it is obvious that prices likely dropped as much as 30% in other locations. This may not appear dramatic when compared to the price drops that occurred in the US in the 2008/2009 financial crisis; yet we should remember that the 20% or so price drop occurred in the context of a 20% or so expected price increase, making the total ‘reality versus expectation’ gap a severe ~ 40%.

What gives confidence are measurements taken by the government in order to provide liquidity to the market as well as the announcement from the central government to do anything and everything needed in order to end deflation and stimulate the overall economy. Another encouraging sign is that since Q4 of 2024 we have been seeing international institutional investors such as pension funds and large private equity firms again underwriting industrial real estate investment projects in China. After about two years without such influx of capital, this will certainly give a boost to investor confidence in 2025.