Government’s new ‘Red Lines’ policy dramatically changes the game for real estate developers and property investment firms.

Increasing Challenges

China’s big real estate companies had already been struggling, their profit margins squeezed in recent years by rising land costs, leveling off of rising building prices and rents, and strict caps on buildable floor area. It didn’t help also that government repeatedly cooled demand for residential projects via new restrictions on mortgages and home purchases.

Many investors and developers began to accumulate high levels of debt and approach insolvency – a result very predictable, especially in hindsight.

The new ‘Three Red Lines’ policy, in contrast, seems to have caught many real estate power players by surprise, with the new rules shining a blazing spotlight on balance sheets that are far less healthy than many may have previously thought.

What are the ‘Three Red Lines’?

The Three Red Lines mainly address regulations on financing for real estate projects. They specify that for a company like a real estate developer…

1) …liabilities should not exceed 70% of total asset value; and firms can no longer count income derived from down payments as part of asset, as many customarily had done

2) …total debt may not exceed an amount equal to 100% of equity

3) … must have a cash to short-term loans ratio of at least one.

Implementation and Impact

Companies are reviewed – somewhat similar to bank stress tests recently popular in the Western World – and categorized based on whether or not they breach any or several of the mentioned ‘red lines’.

Simply put, a company that doesn’t breach any of the specified boundaries is rated as ‘green’, breaching one parameter is rated as ‘yellow’, breaching two ‘orange’ and breaching all three ‘red’. Currently, even some of the most prestigious real estate developers in China appear to fall into the ‘red’ category.

Prominent Examples

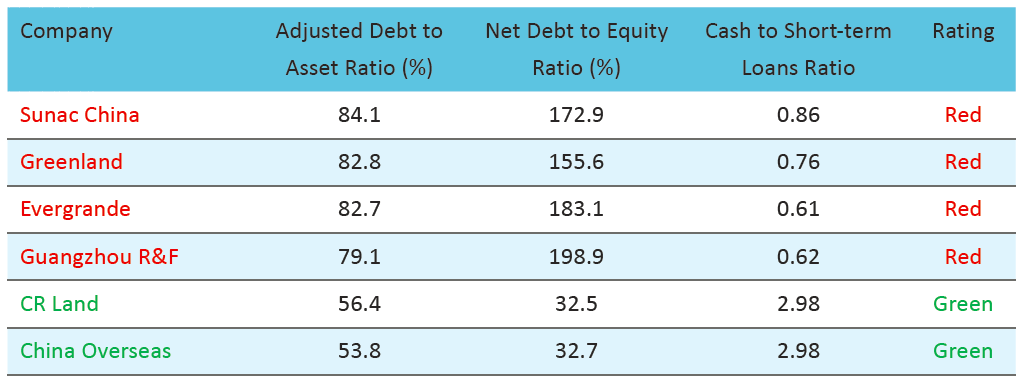

Based on publicly available data, famous property developers such as Greenland, Evergrande, Guangzhou R&F and Sunac China fall into the red category, whereas developers such as CR Land and China Overseas Development fall into the green category. Below is a table of these firms and their respective debt ratios and rankings:

Consequences for property industry

While the new policies may present a crisis and, in some cases, even a death blow for overleveraged players, they will likely succeed in ensuring that real estate projects are sufficiently funded. Many real estate developers had achieved fast growth by continuously acquiring and developing land, and buying up other real estate firms. This is what led to increased levels of debt and the need for risky, short-term financing.

While the new policies may prevent such fast-paced and speculative property investment and will likely stabilize the financial health of developers and other property firms, they may also lead to a slower supply of new properties. The new policies are therefore unlikely to cool the property market down in the sense of decreasing price levels, since less supply is obviously not a driver of lower prices but a lever that tends to make them go up.