Investment, development in non-central areas, and changing market conditions were the big themes in Shanghai’s commercial real estate industry during 2013. We’ve rounded up what we view as the year’s major events and list them below, along with some thoughts on how things may develop in the months ahead.

Investment pours in

With the government continuing to restrict investment in residential property, commercial real estate in Shanghai attracted significant investment during 2013, and a number of foreign firms were among the buyers. Major deals included:

• The $USD 1.55 billion purchase by Bank of Communications of the OrientalFinancial Center in Lujiazui, a building scheduled for completion this year, from Hutchison Whampoa

• Carlyle Group’s acquisition of Central Plaza from Singapore’s Forterra Trust, a 1.6 billion RMB deal

• The sale of Ocean Tower on Yanan Road by Ascendas for 1.9 billion RMB, the buyer being Singapore-listed fund manager ARA

• Ascendas also reportedly sold Cross Tower to Hong Kong based Gaw Capital for around 1.67 billion RMB

• Gaohe Capital paid 790 million RMB to buy the China Enterprise Tower in Jingan district

• Real estate investment firm MGPA paid 263.5 million RMB to purchase several floors in J- Tower, a new building in Jiading county developed by the Chongbang Group.

The sale of the Oriental Financial Centre was big news not only because it was the largest deal of the year, but also because the seller happened to be Hong Kong billionaire Li Ka-shing, who is famous for ability to predict the direction of real estate markets. Commentators joked that Li’s decision to sell may have made those who had bought buildings a little nervous.

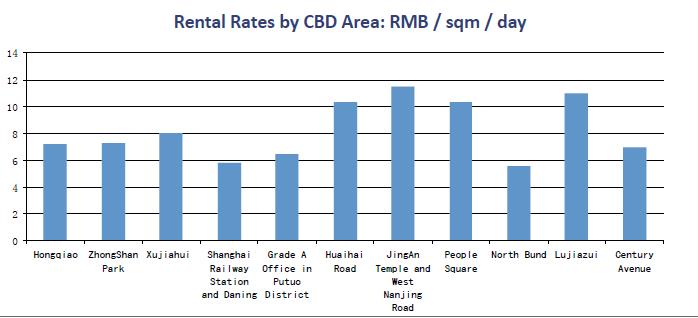

Rents rise slower in most of city

Around the 2nd quarter it became clear that Shanghai office rents, having continuously increased at a sharp rate since mid-2010, were finally rising at a slower rate. Although the average city-wide rent is still going up, the rate of increase dropped significantly in most districts over the year. Landlords of some key office buildings within the CBDs of Nanjing West Road, Huaihai Middle Road and Xujiahui even had to lower their proposed rates once or twice after realizing that potential tenants were not taking the bait.

….but continue to rise fast in Hongqiao and Lujiazui

Photo by seriousbri / CC BY, SOFIA GROUP The Scene The slowdown in the rise of rents did not happen in Lujiazui and Hongqiao. Lujiazui rates are still climbing fast because financial industry firms and those serving them all want to be in the tightly packed district. In Hongqiao a number of factors are keeping rents on the upward fast track, among them the fact that rents in the area are still low compared with Nanjing Road and Huaihai Road; the abundance of metro stations that have opened up in the area in recent years and development that has taken place around them; and government plans to transform the district a major regional transportation hub.

The new L’Avenue development on Zunyi Road seems to embody Hongqiao’s new status as the rising star business hub in Puxi. Officially opened last April, the office tower at L’Avenue had achieved 90% occupancy by the end of 2013 and its attached mall is filled with high-end retailers. Only the top floor of the tower was without a tenant at year’s end.

Development trends outward

Like a young forest filling up with trees, Shanghai continued to fill up and expand outward with the opening of newly built developments and infrastructure in 2013. This filling out trend is perhaps most conspicuous in the opening of new malls, many of them mixed-use developments that include an office tower component. Online sources list more than 50 such project that opened in Shanghai and its suburbs, and some of the major ones downtown or close by included:

• Kerry Centre Phase II on Nanjing West Road

• K11 and IAPM malls on Huaihai Middle Road

• L’Avenue in Hongqiao

• The enormous Global Harbour development on the corner of Zhongshan West Road and Jinshajiang Road

• Touch Mall on Zhongshan South Road by Dong An Road

Notable infrastructure developments in 2013 included the completion of subway line 12, which connects Minhang and Yangpu districts, passing through central downtown along the way; line 16 running through outer Pudong; and the opening of the Changning-Pudong section of line 11.

Looking ahead

Although tenants in the city surely hope that the average rate of rental increase will continue to slow down to the point of zero, we don’t see this happening in 2014. Within the inner ring road there will be only a few developments of significance opening up during the year, and with the average occupancy rate at around 80, landlords still have considerable leverage. Moreover, China’s short-term economic prospects appear largely positive, which suggests strong demand for office space in Shanghai will continue in the months ahead.

Market Data – Rents and Occupancies

Notable recent and upcoming market events include the handing over of Shanghai Arch, last November. The relatively low rents being offered for space inside this high quality new building are surely exerting downward pressure on rents of the area’s older office towers. Further new office space supply will also soon arrive in Puxi with the opening of Henderson 688 Plaza near the Shanghai TV Tower on West Nanjing Road, and the full opening of Corporate Avenue beside Xintiandi.

Meanwhile, Lujiazui saw no new building openings in 2013 and occupancies will remain sky high there in the monthsahead.