Strange measurements

For many years now, officially reported measures of inflation such as the Consumer Price Index (CPI) have been lower than the inflation that urban dwellers seem to experience in countries such as the US, UK, Germany and China.

One reason is that CPIs of these countries fail to give sufficient weight to real price increases in the costs of key expenditures such as rent and fuel. Together, these two items alone typically take up 30 to 40% of total urban household expenditures, and they often increase in price more dramatically than other consumption items.

The US’s CPI (as an example), gives only a 7% weight to market-rate housing rents, while giving a 24% weight to a much slower changing, artificially derived measure of rental price called “Owner’s equivalent rent of residences”. The result, unsurprisingly, is a CPI that is much lower than it would otherwise be.

What M2 Tells Us

We point this out because inflation can have wide ranging negative impact on businesses and individual lives. And judging by the data, the current situation of high inflation looks pretty bad.

Many companies we deal with cite pandemic-induced supply issues as a key factor driving up costs for their businesses. But while supply chain issues may be one factor, economists now seem to widely agree that the biggest cause of current global inflation is the huge increases in the money supply of many countries over the past decade.

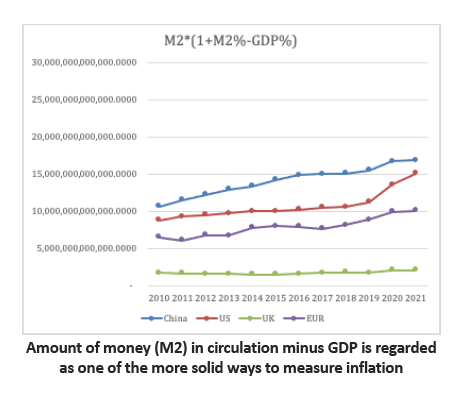

Looking at the chart below, it feels hard to imagine how this could not be the case. It shows the amount of money (M2) in circulation minus GDP growth, showing that M2 grew much faster than GDP growth would justify.

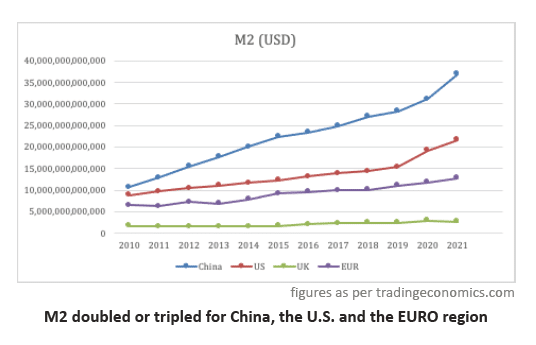

Between 2011 and 2021 the amount of money in circulation in the U.S. doubled (measured in M2 from about USD 9 trillion

to about USD 19 trillion). In the Euro-Zone the situation was similar, money in circulation went from about EUR 8 trillion to about EUR 15 trillion, and in China from about CNY 90 trillion to about CNY 240 trillion. Note that although M2 seems to have increased most rapidly during the pandemic, especially for USD and CNY, it certainly didn’t start with the pandemic: the E.U. had done it for projects such as ‘bailing out Greece’, the U.S. in order to fund costly wars, etc.

As money supply increases, there is typically a time-delay of months or years before it manifests as inflation. It is possible that high inflation rates recorded in recent months are just the beginning of this ‘correction’ of the value of money and goods.

Better of two evils, but still pretty wicked

Economists around the globe have criticized their governments for irresponsible behavior when lowering interest rates to rockbottom, engaging in quantitative easing and so on, warning that the painful bill for all the miraculously created additional liquidity would one day need to be paid.

But maybe the government spending was the lesser of two evils. We avoided the collapse of banks and whole national economies during the Covid-related shutdowns. Now the burden everyone needs to shoulder is that their money can buy less than before.

Worst is yet to come

For people owning fixed assets such as land, real estate, gold etc. the effect of inflation tends to be less relevant. While real estate costs more, both in terms of land cost, construction cost or when buying existing buildings, premises are also worth more and will bring in more revenue with rents growing.

Rents for real estate in high demand, such as apartments, multifamily condos, villas, factories, warehouses etc. keep rising fast in most countries. For everyone who is renting this is bad news.

While those who still work can expect increasing wages due to inflation, elderly people who rely on interests or pensions will perhaps suffer the most economic pain, as they have little recourse to compensate for their shrunken sources of income.

On the governmental level, the need for governments to keep inflation under control means that there will be less budgets available for stimulus packages etc. while all the repercussions from earlier overspending still have to be dealt with.

Outlook of real estate prices in coming months

Given a market environment where supply of apartments and other real estate in many major cities around the globe remains scarce, and where inflation is on the rise and interest rates remain low, it is very unlikely for home prices to drop. Prices are far more likely to remain at their current high level or keep climbing.

For people considering real estate investments, the current situation makes it more important than ever to secure longterm fixed-rate financing in order to protect against possibly severe interest rate hikes in the future.