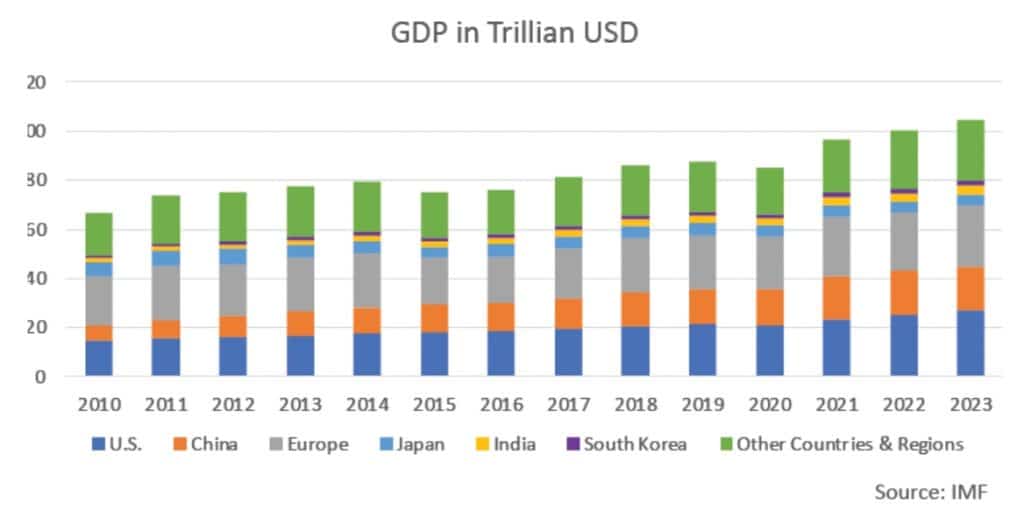

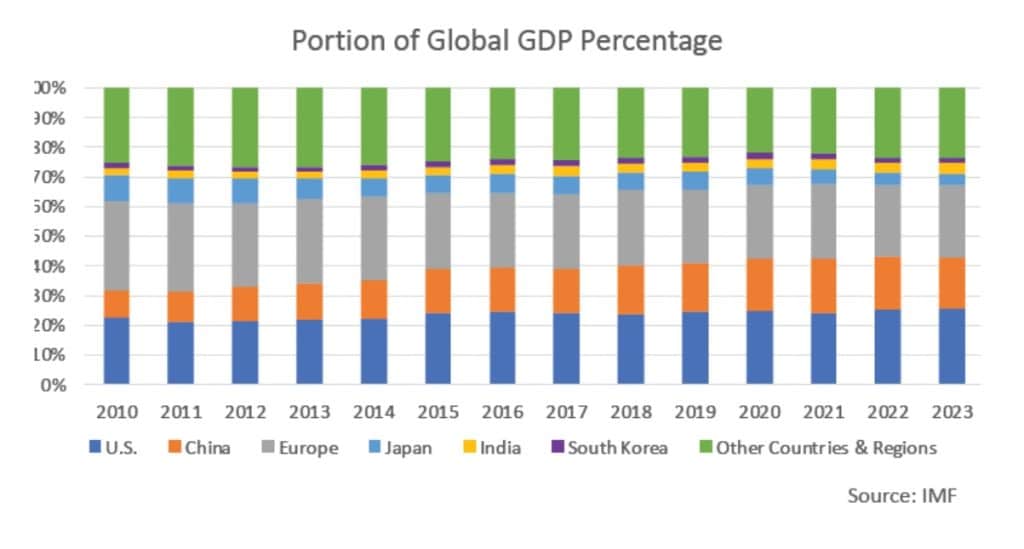

The global economic output grew by about USD 3 trillion during 2023, one-third of that stemming from China, according to estimates by the International Monetary Fund (IMF). Based on this figure it may seem that the Chinese economy is as strong as ever. But there are more troubling figures out there, too. For example, China’s estimated youth unemployment rate of 20%.

Similarly in the Chinese real estate sector: figures may look good ‘on average’, but go into specific locations or market segments and horror stories pop up. In Guangdong Province and other developed areas, properties such as warehouses, cold storage facilities and data centers are enjoying high occupancy rates and increasing rents, and developers are building more of them. But shift your gaze to the residential and commercial markets in tier-3 and -4 cities, and in many cases you see declining prices, plummeting transactions and some projects being delayed so long that buyers fear they’ll never receive the property they partially or fully paid for.

So the present situation is a high-contrast picture of glorious peaks and shadowy lows. Now, looking forward, which China industries and real estate markets will flourish in 2024?

Based on market data from the second half of 2023 and government investment trends, it seems certain that electric vehicles and everything related to them, including battery manufacturing, will continue to grow fast. Other hot industries include photovoltaic and renewable energies, industrial robotics and smart manufacturing, service robots, semiconductor and other integrated circuit products, pharmaceuticals and medical devices. Many sectors within these industries grew between 25 and 45% during 2023.

In the world of real estate, the traditional model of developing apartment complexes to sell has come under huge pressure, as price drops in the range of 15% evaporate developers’ margins, and buyers have lost confidence in future capital gains. Shopping mall properties in many cities are not doing well due to oversupply and the continued growth of e-commerce. Property types that are likely to be hot in 2024 include: warehouses, cold storage facilities, data centers, affordable housing developments, hotels along the coastline and single-story manufacturing premises, this last property type having become precious because zoning laws intended to make efficient use of remaining land have largely prohibited their development.

Needless to say that choosing a ‘good’ location is always vital when it comes to real estate, with factors such as local population and GDP growth, unemployment and infrastructure quality among the indicators that investors must consider.